On Friday, as most everyone knows, the unprecedented CARES Act became law. Its impact on all Americans is substantial, but this Alert is directed to our small business clients. There’s so much information available, and everyone is trying to keep up with the hundreds of emails in inboxes, in addition to the news. This Alert is intended to point out the terms of the two primary federal loan programs available right now, because, as most Connecticut business owners know, the Connecticut Business Bridge Loan stopped accepting applications on Friday at 6:00 pm.

Of note relative to Connecticut, the DECD has deferred all payments for 3 months under all existing DECD Small Business Express Loans without application (approximately 800 loans).

Useful Links/ Resources

Relative to Small Business Loans: Small Business Administration Disaster Loan Information

Relative to CARES Act: Regulations to be passed within 15 days of Friday; see:

Connecticut Coronavirus Small Business Owners Guide to the CARES Act

One significant question for most businesses is whether they will be disqualified if they laid off employees due to the COVID-19 pandemic prior to the beginning of the covered period. There will not be any penalty for having previously laid off employees. This is because an overriding purpose for these loans is to keep employees who have not been laid off working, and to allow employers to rehire those who were.

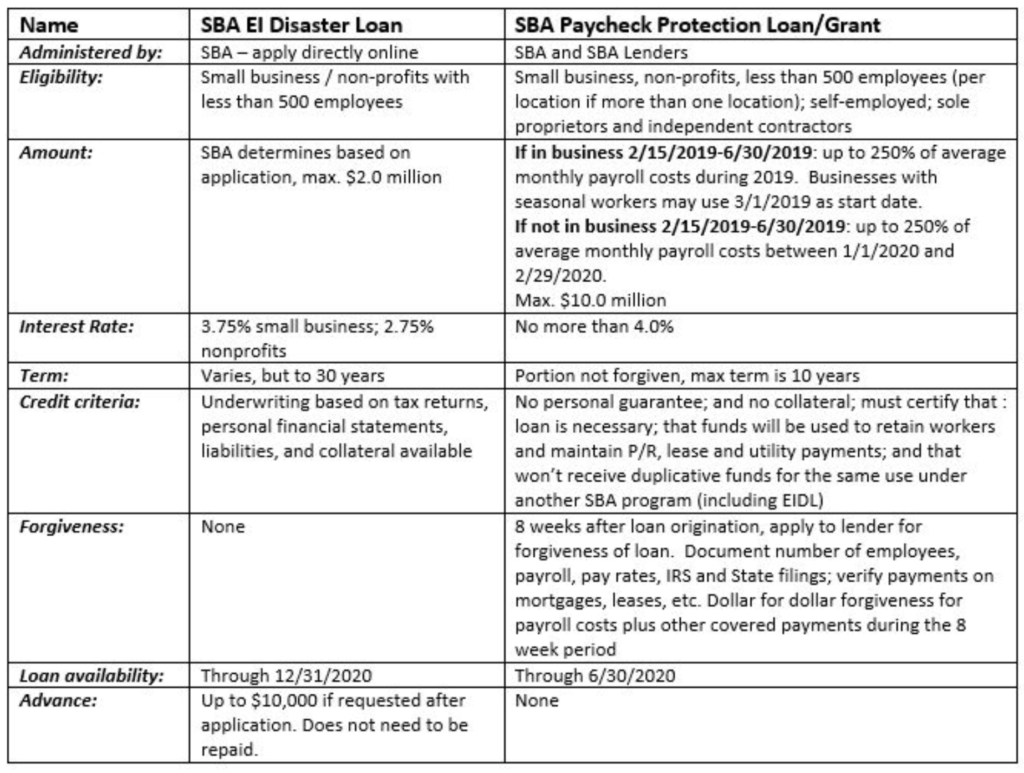

One last note about the loan programs– clients have asked whether they can have / apply for more than one SBA loan. The answer is yes, including without limitation the Economic Injury Disaster Loan described above. The limitation is that the business may not use the proceeds for the same purpose. In other words, if an employer receives a Paycheck Protection Loan for payroll for the months of May and June, 2020, it may not use the proceeds of a Disaster Loan for the same period; however, it could use those proceeds for periods before or after.

Clients are encouraged to apply for both loans.

The CARES Act also contains substantial tax credits for retention of employees, incorporates delays in payment requirements, and includes a number of other provisions that will help employers maintain and preserve liquidity during these unprecedented times. Clients are encouraged to discuss these provisions with their accounting representatives.

Halloran Sage attorneys are available to assist businesses with all of their needs and concerns.

Please stay healthy and safe during this time.

For more information or if you have any specific questions, please contact:

Suzanne M. Scibila | scibilia@halloransage.com | 860.704.6868

Brad N. Malicki | malicki@halloransage.com | 860.704.6856

Read more

Suzanne M. ScibiliaBrad N. Malicki

Labor & Employment